Read 500 pages like this every day. That’s how knowledge works. It builds up, like compound interest. All of you can do it, but I guarantee not many of you will do it. – Warren Buffett

I want to share with you some of the wisdom of Warren Buffett, one of the best investor as well as human being of all time, particularly his letters to partners in the early years of his career. During this time, Buffet had a similar problem with us: trying to engage and educate partners about an unique and complex product (his investment philosophy). The complex product the company’s case is our software system and also each of you has a complex product to write about: yourself (as a professional, lover, partner…). In these writing, apart from the usual takeaways about his quality and clarity of thinking, integrity, humor, etc, I want to highlight a few that are applicable to us:

Noted that we think of our customers as partners like Buffet did, because our software is responsible for the core of the businesses and our success depends heavily on their successes, our actionable goal is business success, not getting more partners.

- Communication is crucial: even when the product is good and speak for itself, or even extremely good in Buffet’s case. Not only customers need to be explained why the product is good, many need to be educated on what is good itself. And no matter how great the product is, there will be a fair amount of doubt and criticism, so we should learn how to address them like Buffet did: with clarity, humor and even enjoyment.

- Complexity can be explained: although Buffet’s investment style is hard to be fully understood by the most brilliant investors, he can explain them in simple terms for his partners who consist of mostly common people with little understanding of investing. The true testimonial to understanding is the ability to explain the problem to a reasonably educated person.

- Values and principles are communicated as often as facts, why do we do what we do is as important as (if not more than) what we do. Although Buffet’s partners were interested in how their money were doing while reading the letters, Buffet took that opportunity to not only communicated what was happening but also a great deal of why he did what he did and what he believe in term of both investment and way of life. This shines though when we decided to close the partnership mostly (but not entirely) because the market situation does not fit his investment style anymore, and instead of continuing to make money by investment fee because of his, still, great performance, he stoped. In his long final letter, he tried to educated the partners, one last time, why principles and values are more important than money and did his best to send his partners off to a good path, proven one crucial principle one more time: relationship is more important than personal gain.

Now please enjoy these various excerpts:

Taxes

We have had a chorus of groans this year regarding partners’ tax liabilities. Of course, we also might have had a few if the tax sheet had gone out blank.

More investment sins are probably committed by otherwise quite intelligent people because of “tax considerations” than from any other cause. One of my friends – a noted West Coast philosopher maintains that a majority of life’s errors are caused by forgetting what one is really trying to do. This is certainly the case when an emotionally supercharged element like taxes enters the picture (I have another friend -a noted East Coast philosopher who says it isn’t the lack of representation he minds -it’s the taxation).

…

I have a large percentage of pragmatists in the audience so I had better get off that idealistic kick. There are only three ways to avoid ultimately paying the tax: (1) die with the asset – and that’s a little too ultimate for me even the zealots would have to view this “cure” with mixed emotions; (2) give the asset away – you certainly don’t pay any taxes this way, but of course you don’t pay for any groceries, rent, etc., either; and (3) lose back the gain if your mouth waters at this tax-saver, I have to admire you -you certainly have the courage of your convictions.

So it is going to continue to be the policy of BPL to try to maximize investment gains, not minimize taxes. We will do our level best to create the maximum revenue for the Treasury -at the lowest rates the rules will allow.

The Joys of Compounding

I have it from unreliable sources that the cost of the voyage Isabella originally underwrote for Columbus was approximately $30,000. This has been considered at least a moderately successful utilization of venture capital. Without attempting to evaluate the psychic income derived from finding a new hemisphere, it must be pointed out that even had squatter’s rights prevailed, the whole deal was not exactly another IBM. Figured very roughly, the $30,000 invested at 4% compounded annually would have amounted to something like $2,000,000,000,000 (that’s $2 trillion for those of you who are not government statisticians) by 1962. Historical apologists for the Indians of Manhattan may find refuge in similar calculations. Such fanciful geometric progressions illustrate the value of either living a long time, or compounding your money at a decent rate. I have nothing particularly helpful to say on the former point.

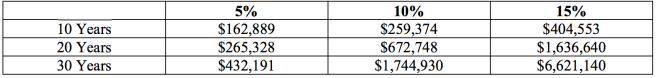

The following table indicates the compounded value of $100,000 at 5%, 10% and 15% for 10, 20 and 30 years. It is always startling to see how relatively small differences in rates add up to very significant sums over a period of years. That is why, even though we are shooting for more, we feel that a few percentage points advantage over the Dow is a very worthwhile achievement. It can mean a lot of dollars over a decade or two.

The Question of Conservatism

The above description of our various areas of operation may provide some clues as to how conservatively our portfolio is invested. Many people some years back thought they were behaving in the most conservative manner by purchasing medium or long-term municipal or government bonds. This policy has produced substantial market depreciation in many cases, and most certainly has failed to maintain or increase real buying power.

Conscious, perhaps overly conscious, of inflation, many people now feel that they are behaving in a conservative manner by buying blue chip securities almost regardless of price-earnings ratios, dividend yields, etc. Without the benefit of hindsight as ill the bond example, I feel this course of action is fraught with danger. There is nothing at all conservative, in my opinion, about speculating as to just how high a multiplier a greedy and capricious public will put on earnings. You will not be right simply because a large number of people momentarily agree with you. You will not be right simply because important people agree with you. In many quarters the simultaneous occurrence of the two above factors is enough to make a course of action meet the test of conservatism.

You will be right, over the course of many transactions, if your hypotheses are correct, your facts are correct, and your reasoning is correct. True conservatism is only possible through knowledge and reason.

I might add that in no way does the fact that our portfolio is not conventional prove that we are more conservative or less conservative than standard methods of investing. This can only be determined by examining the methods or examining the results.

I feel the most objective test as to just how conservative our manner of investing is arises through evaluation of performance in down markets. Preferably these should involve a substantial decline in the Dow. Our performance in the rather mild declines of 1957 and 1960 would confirm my hypothesis that we invest in an extremely conservative manner. I would welcome any partner’s suggesting objective tests as to conservatism to see how we stack up. We have never suffered a realized loss of more than 0.5% of 1% of total net assets, and our ratio of total dollars of realized gains to total realized losses is something like 100 to 1. Of course; this reflects the fact that on balance we have been operating in an up market. However, there have been many opportunities for loss transactions even in markets such as these (you may have found out about a few of these yourselves) so I think the above facts have some significance.

In looking at the table of investment company performance, the question might be asked: “Yes, but aren’t those companies run more conservatively than the Partnership?” If you asked that question of the investment company managements, they, in absolute honesty, would say they were more conservative. If you asked the first hundred security analysts you met, I am sure that a very large majority of them also would answer for the investment companies. I would disagree. I have over 90% of my net worth in BPL, and most of my family have percentages in that area, but of course, that only demonstrates the sincerity of my view – not the validity of it.

It is unquestionably true that the investment companies have their money more conventionally invested than we do. To many people conventionality is indistinguishable from conservatism. In my view, this represents erroneous thinking. Neither a conventional nor an unconventional approach, per se, is conservative.

Truly conservative actions arise from intelligent hypotheses, correct facts and sound reasoning. These qualities may lead to conventional acts, but there have been many times when they have led to unorthodoxy. In some corner of the world they are probably still holding regular meetings of the Flat Earth Society.

We derive no comfort because important people, vocal people, or great numbers of people agree with us. Nor do we derive comfort if they don’t. A public opinion poll is no substitute for thought. When we really sit back with a smile on our face is when we run into a situation we can understand, where the facts are ascertainable and clear, and the course of action obvious. In that case – whether other conventional or unconventional – whether others agree or disagree – we feel – we are progressing in a conservative manner.

The above may seem highly subjective. It is. You should prefer an objective approach to the question. I do. My suggestion as to one rational way to evaluate the conservativeness of past policies is to study performance in declining markets. We have only three years of declining markets in our table and unfortunately (for purposes of this test only) they were all moderate declines. In all three of these years we achieved appreciably better investment results than any of the more conventional portfolios.

Specifically, if those three years had occurred in sequence, the cumulative results would have been:

Tri-Continental Corp. -9.7%

Dow -20.6%

Mass. Investors Trust -20.9%

Lehman Corp. -22.3%

Investors Stock Fund -24.6%

Limited Partners +45.0%

We don’t think this comparison is all important, but we do think it has some relevance. We certainly think it makes more sense than saying “We own (regardless of price) A.T. &T., General Electric, IBM and General Motors and are therefore conservative.” In any event, evaluation of the conservatism of any investment program or management (including self-management) should be based upon rational objective standards, and I suggest performance in declining markets to be at least one meaningful test.

Relationship

The satisfying nature of our activity in controlled companies is a minor reason for the moderated investment objectives discussed in the October 9th letter. When I am dealing with people I like, in businesses I find stimulating (what business isn’t ?), and achieving worthwhile overall returns on capital employed (say, 10 – 12%), it seems foolish to rush from situation to situation to earn a few more percentage points. It also does not seem sensible to me to trade known pleasant personal relationships with high grade people, at a decent rate of return, for possible irritation, aggravation or worse at potentially higher returns. Hence, we will continue to keep a portion of our capital (but not over 40% because of the possible liquidity requirements arising from the nature of our partnership agreement) invested in controlled operating businesses at an expected rate of return below that inherent in an aggressive stock market operation.

Furthermore, we will not follow the frequently prevalent approach of investing in securities where an attempt to anticipate market action overrides business valuations. Such so-called “fashion” investing has frequently produced very substantial and quick profits in recent years (and currently as I write this in January). It represents an investment technique whose soundness I can neither affirm nor deny. It does not completely satisfy my intellect (or perhaps my prejudices), and most definitely does not fit my temperament. I will not invest my own money based upon such an approach hence, I will most certainly not do so with your money.

The above may simply be “old-fogeyism” (after all, I am 37). When the game is no longer being played your way, it is only human to say the new approach is all wrong, bound to lead to trouble, etc. I have been scornful of such behavior by others in the past. I have also seen the penalties incurred by those who evaluate conditions as they were – not as they are. Essentially I am out of step with present conditions. On one point, however, I am clear. I will not abandon a previous approach whose logic I understand (although I find it difficult to apply) even though it may mean foregoing large and apparently easy, profits to embrace an approach which I don’t fully understand,

In recommending Bill, I am engaging in the sort of activity I have tried to avoid in BPL portfolio activities – a decision where there is nothing to gain (personally) and considerable to lose. Some of my friends who are not in the Partnership have suggested that I make no recommendation since, if results were excellent it would do me no good and, if something went wrong, I might well get a portion of the blame. If you and I had just had a normal commercial relationship, such reasoning might be sound. However, the degree of trust partners have extended to me and the cooperation manifested in various ways precludes such a “hands off” policy. Many of you are professional investors or close thereto and need no advice from me on managers – you may well do better yourself. For those partners who are financially inexperienced. I feel it would be totally unfair for me to assume a passive position and deliver you to the most persuasive salesman who happened to contact you early in 1970.

There is no way to eliminate the possibility of error when judging humans particularly in regard to future behavior in an unknown environment. However, decisions have to be made – whether actively or passively – and I consider Bill to be an exceptionally high probability decision on character and a high probability one on investment performance. I also consider it likely that Bill will continue as a money manager for many years to come.